How COVID-19 Is Impacting the Digital Transformation Journey of Small Businesses

Every small business goes on a unique digital transformation journey. Some thrive on nothing but paper files and basic apps for their entire lifespan. Others implement new technologies frequently in response to growth goals and market shifts. Regardless, it has always largely been up to small businesses as to when and how they digitize.

The coronavirus/COVID-19 pandemic has changed all of that.

Now, government-mandated closures and social distancing requirements are forcing businesses that rely on in-person interactions to suddenly change the trajectory of their digital transformation journey. And the stakes couldn’t be higher. For many, the decision is to digitize or shut down for good.

To better understand how small businesses are navigating these trying times (and to help those who find themselves in a similar digital dilemma), Software Advice surveyed nearly 150 leaders at non-digital small businesses (NDSBs).

Our findings, presented below, illustrate not only how dire the situation is for small businesses impacted by this pandemic, but how much they’re willing to change everything about how they operate to stay open.

To learn more about our survey methodology, click here.

Time is running out for non-digital businesses

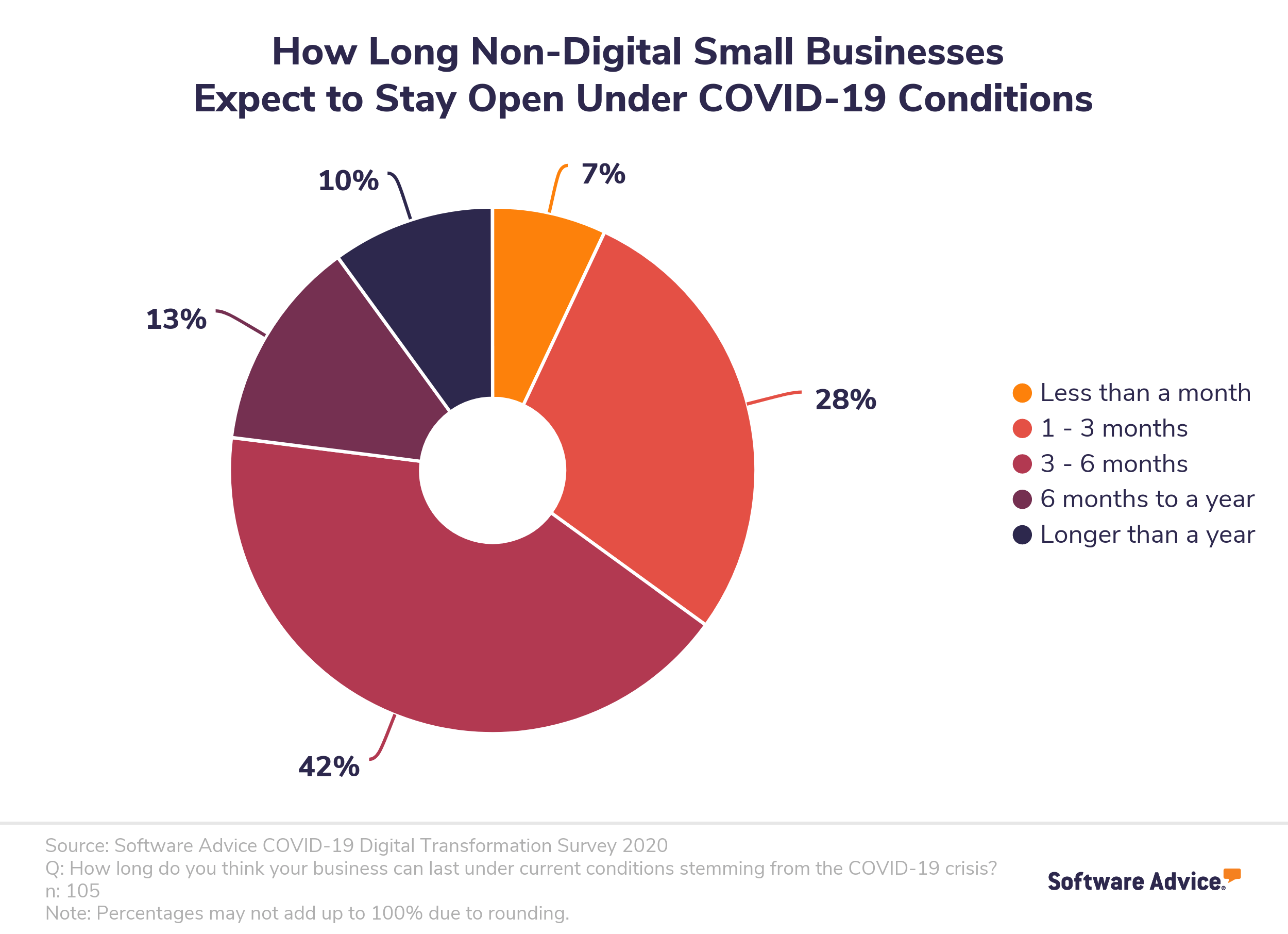

Key stat: Three out of every four (76%) non-digital small businesses negatively impacted by COVID-19 expect to last six months or less under current conditions.

Operating on thin margins with little to no safety net, millions of non-digital small businesses around the U.S.—from restaurants and retail stores to field service providers and construction companies—have the odds stacked against them as it is. Bureau of Labor Statistics (BLS) data says 20% of such businesses fail within their first year and half fail within five years.

Throw a global pandemic in the mix, where 80% of small businesses are dealing with slower sales, 31% are experiencing supply chain disruptions, and 23% have sick employees, and you’re looking at an unprecedented situation even long-standing businesses won’t survive.

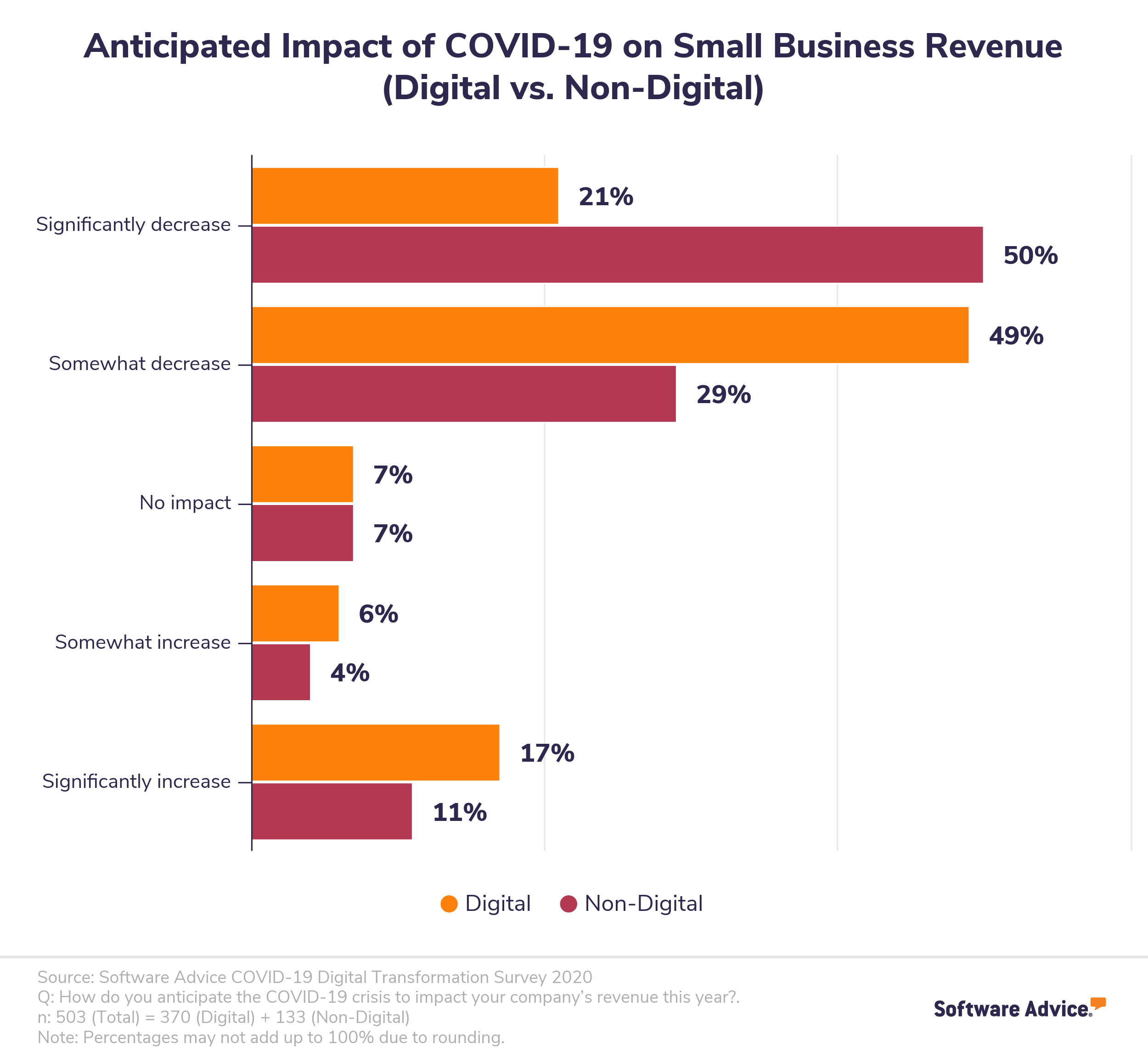

Unable to keep storefronts open or interact with customers face-to-face, NDSBs are being hit especially hard. Half of NDSB leaders say they expect a significant revenue decline this year because of COVID-19, compared to only 21% of their digital counterparts.

The unexpected downturn is forcing NDSBs to make difficult decisions. A majority have already implemented or plan to implement cost-cutting measures such as hiring freezes (62%), canceling travel and events (53%), and reducing marketing spend (51%). More than a third are being forced to furlough (37%) or lay off (35%) workers.

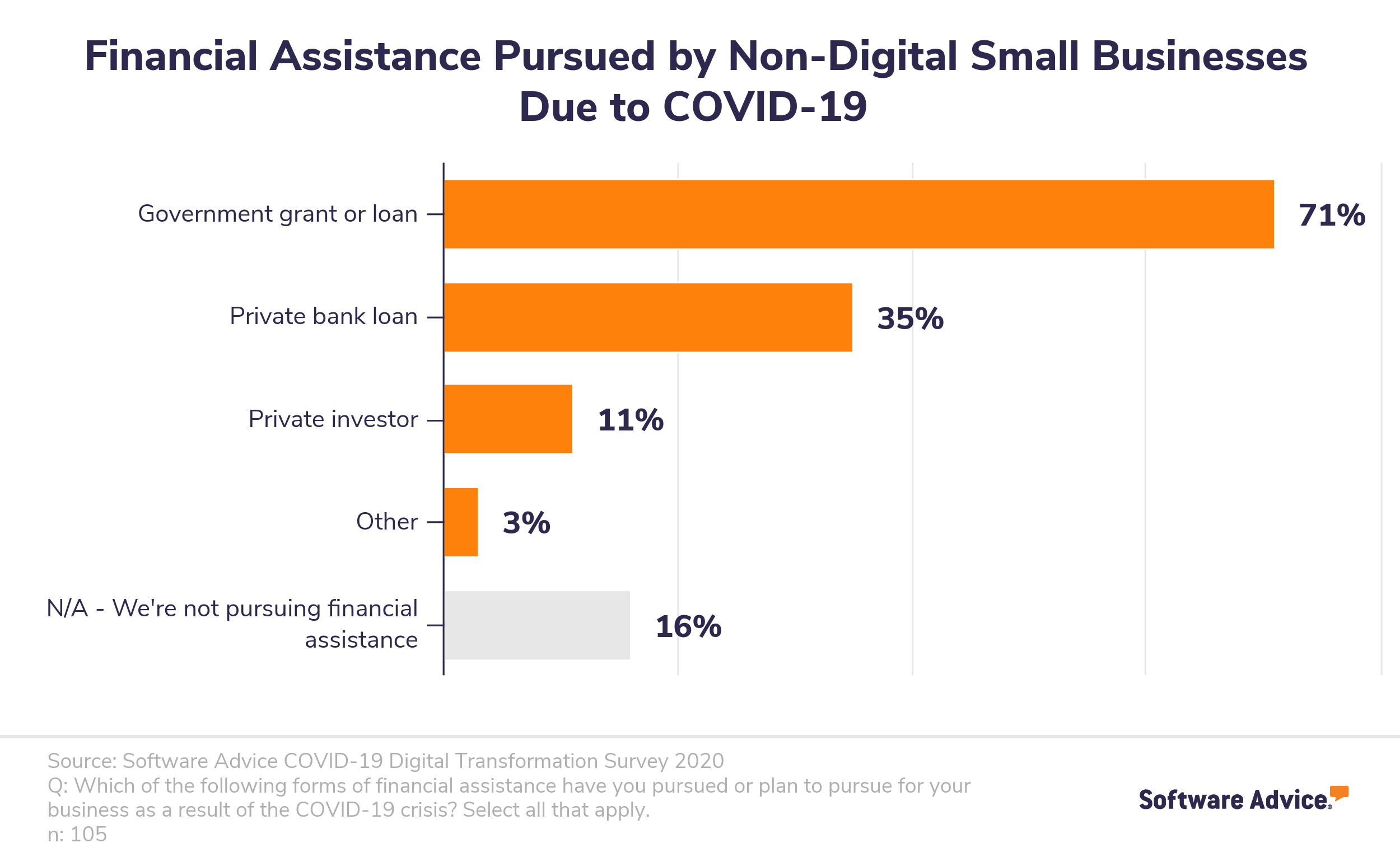

They’re also seeking help. Of the 79% of NDSBs expecting 2020 revenue declines due to COVID-19, 84% are pursuing at least one form of financial assistance.

Is it enough? With businesses running out of cost-cutting levers to pull, initial government funds set aside for small business aid depleted, and no clear timeline on when things will return to normal, it’s unlikely.

And the clock is ticking. Of the non-digital small business leaders experiencing declining revenue we surveyed, roughly three in four (76%) say they don’t expect their business to last longer than six months under current conditions.

The Bottom Line: Time is running out for non-digital small businesses. Running out of cost-cutting measures to implement and financial aid to maintain cash flow, a majority won’t last longer than six months under current conditions. If they don’t make significant changes to their business, and soon, they won’t last.

To survive, non-digital small businesses are making major changes to the way they operate—some of them permanent

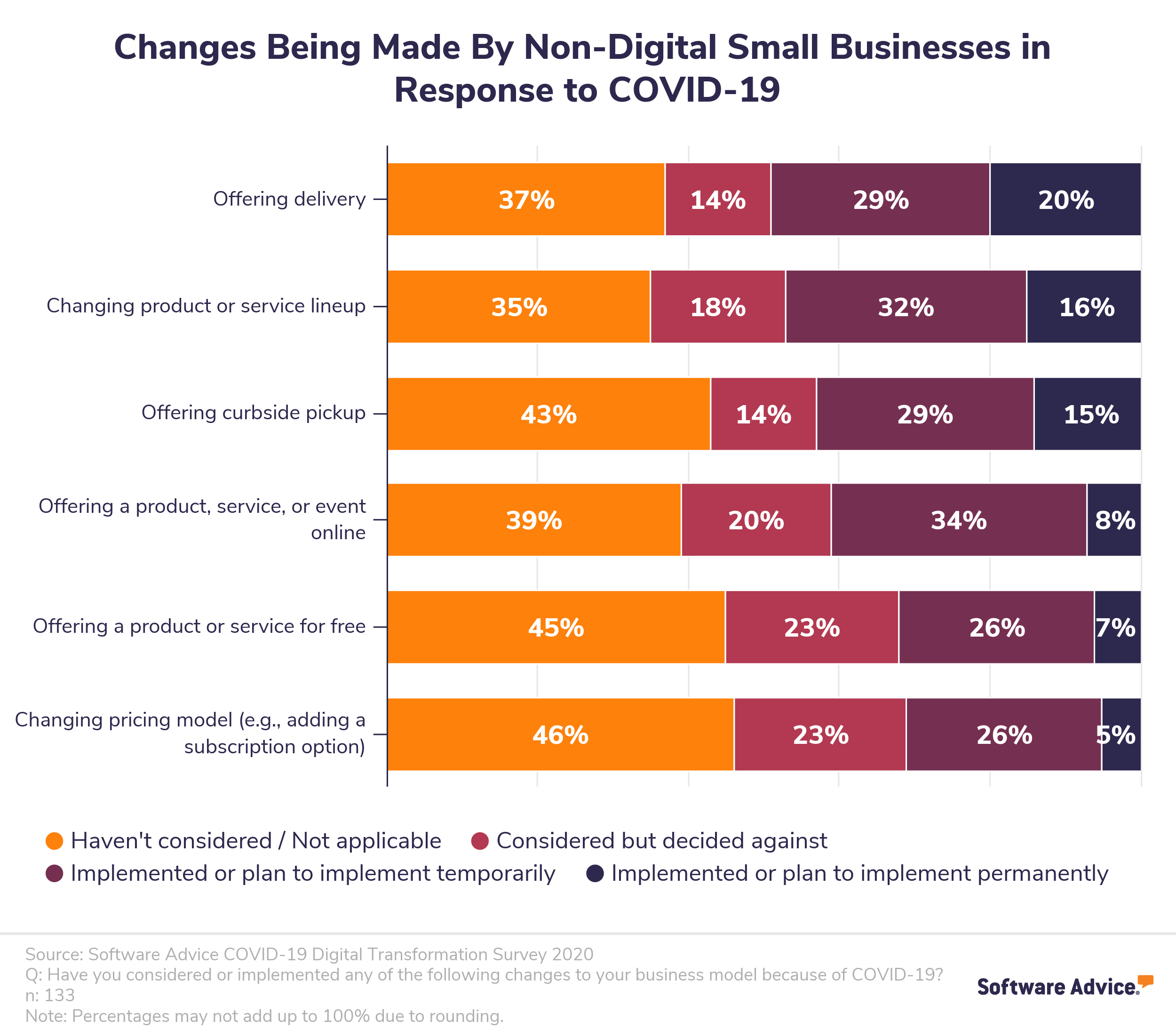

Key stat: Changes made by non-digital small businesses in response to COVID-19 include offering delivery (49%) and curbside pickup (44%), and changing their product or service lineup (48%).

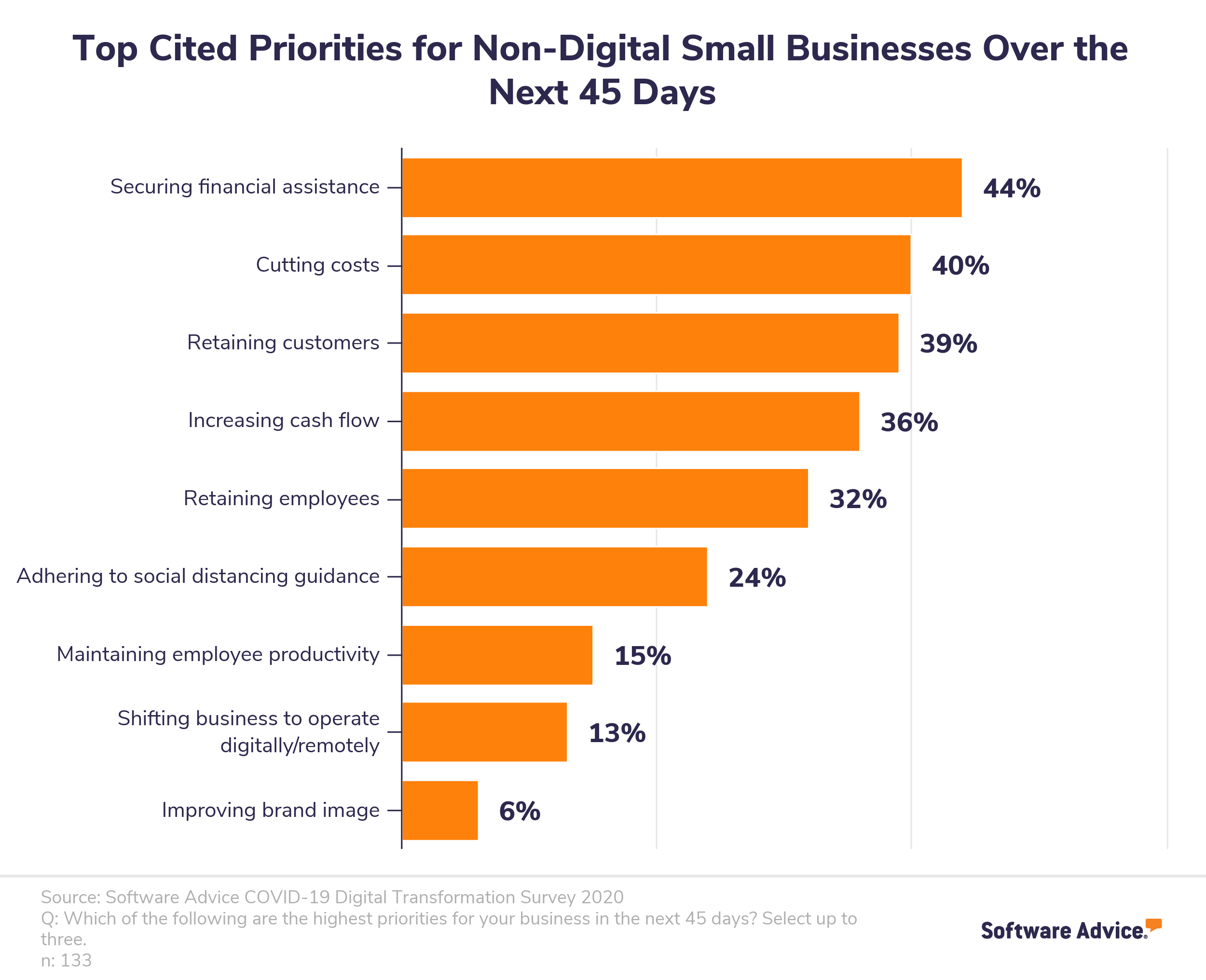

Facing disaster, NDSBs are shifting their priorities. When we asked NDSB leaders what they’re focusing on over the next 45 days, the top answers were securing financial assistance (44%), cutting costs (40%), and retaining customers (39%).

We’ve already covered the top two, so let’s focus on the third: retaining customers. In order to continue delivering value to customers amidst various restrictions and disruptions, NDSBs are making significant changes.

Nearly half of the NDSBs (49%) we surveyed have implemented or are planning to implement delivery service in response to COVID-19. More than a third of those making this change are planning to do so permanently (38%).

Other changes include altering product or service lineups (48%), and offering the option for curbside pickup (44%).

But perhaps the most significant change these non-digital businesses are having to make is entering the world of ecommerce; a full 34% are now offering a product, service, or event online. That’s the number one temporary change being made among our survey respondents.

Though it’s a growing part of our lives, many small businesses haven’t taken the ecommerce plunge. In a 2018 Gallup survey, 40% of small businesses said none of their business was conducted online, and 26% attributed less than a tenth of their sales to ecommerce.

Now, because of COVID-19, many are being forced to rely heavily on online sales. And instead of taking weeks or months to research ecommerce options, set up a digital storefront, align listings with inventory, and set up multiple online payment options, they’re doing it all within just a few days.

Case story: Longhorn Meat Market

James Leach

owner of Longhorn Meat Market

Social media was going to be the extent of our technology. I had no plans for creating an online shopping experience for raw meat.

James Leach

Open since 1892, Longhorn Meat Market in Austin, TX is everything you’d imagine an old-school, family-owned butcher shop to be. Taking orders over the phone or at the counter, and writing everything down on paper invoices put in boxes labeled with the days of the week, Longhorn had little need for modern technology.

But when the Austin government shut down restaurants in late March, Longhorn saw its wholesale business—representing 70% of their revenue—disappear overnight. And with major grocery store chains like H-E-B quickly selling out of meat, Longhorn’s retail side exploded with droves of new customers.

For a few days, Longhorn tried to operate like usual. But with only four people allowed in the butcher’s small space at one time due to social distancing requirements, waiting times quickly ballooned to upwards of two hours, all with the phone ringing off the hook.

Just 10 days after government restrictions were enacted, owner James Leach had to do what was previously unthinkable: Bring his family’s century-old butcher shop online.

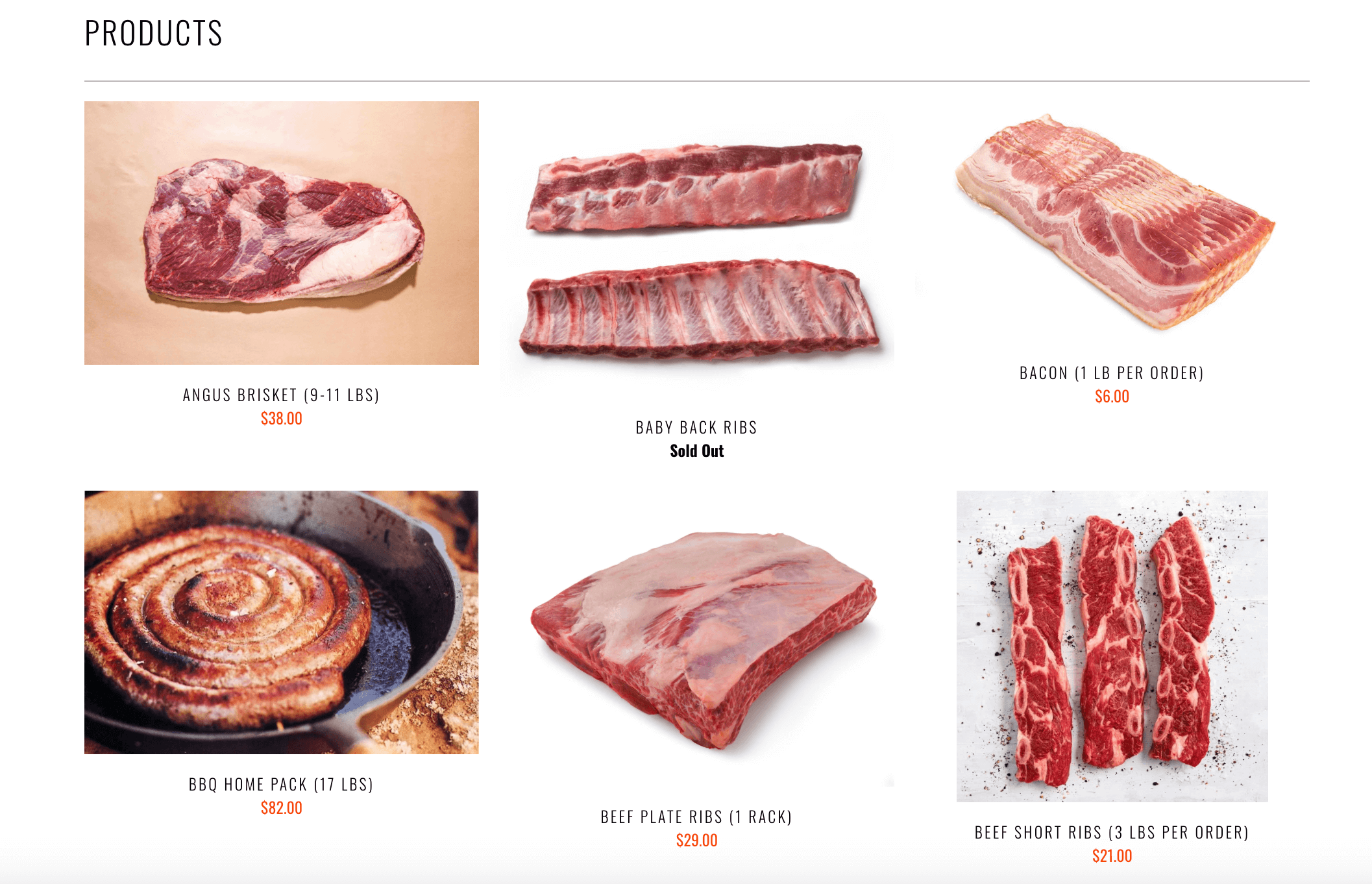

Customers can order meat for curbside pickup or delivery through Longhorn Meat Market’s ecommerce store.

Using ecommerce platform Shopify, Leach set up a store on the company’s website where customers could order meat for curbside pickup. After a few days, he added an option for local delivery. It worked too well. Overnight, the shop received 152 new orders—far more than they could handle. Since then, he’s dialed back the delivery scope to better accommodate demand.

There have been other obstacles, too. Though most of Longhorn’s customers have been patient and understanding with their sudden pivot and increased popularity, a few have expressed frustration with order mistakes in online reviews. Leach is trying to hire someone to handle customer service, while also looking into Salesforce to better capture and respond to customer feedback.

Overall, Longhorn is having to work much harder to make the same amount of money, and a lot of big questions and speed bumps lie ahead. But when the alternative was shutting down, the decision to go digital was an easy one. Leach is even considering adding a ButcherBox-like subscription service in the future.

“A butcher shop that was on paper ledgers is now looking at hiring web developers to do custom code for our ecommerce business within a 10-day period,” Leach says. “It’s just crazy.”

The Bottom Line: In addition to seeking financial aid and cutting costs, non-digital small businesses are prioritizing making significant changes to their business to retain customers. And whether it’s offering delivery or enabling ecommerce, they need software to make it happen. Simply put, their digital transformation journey is happening sooner than expected.

Non-digital small businesses are altering their digital transformation journey

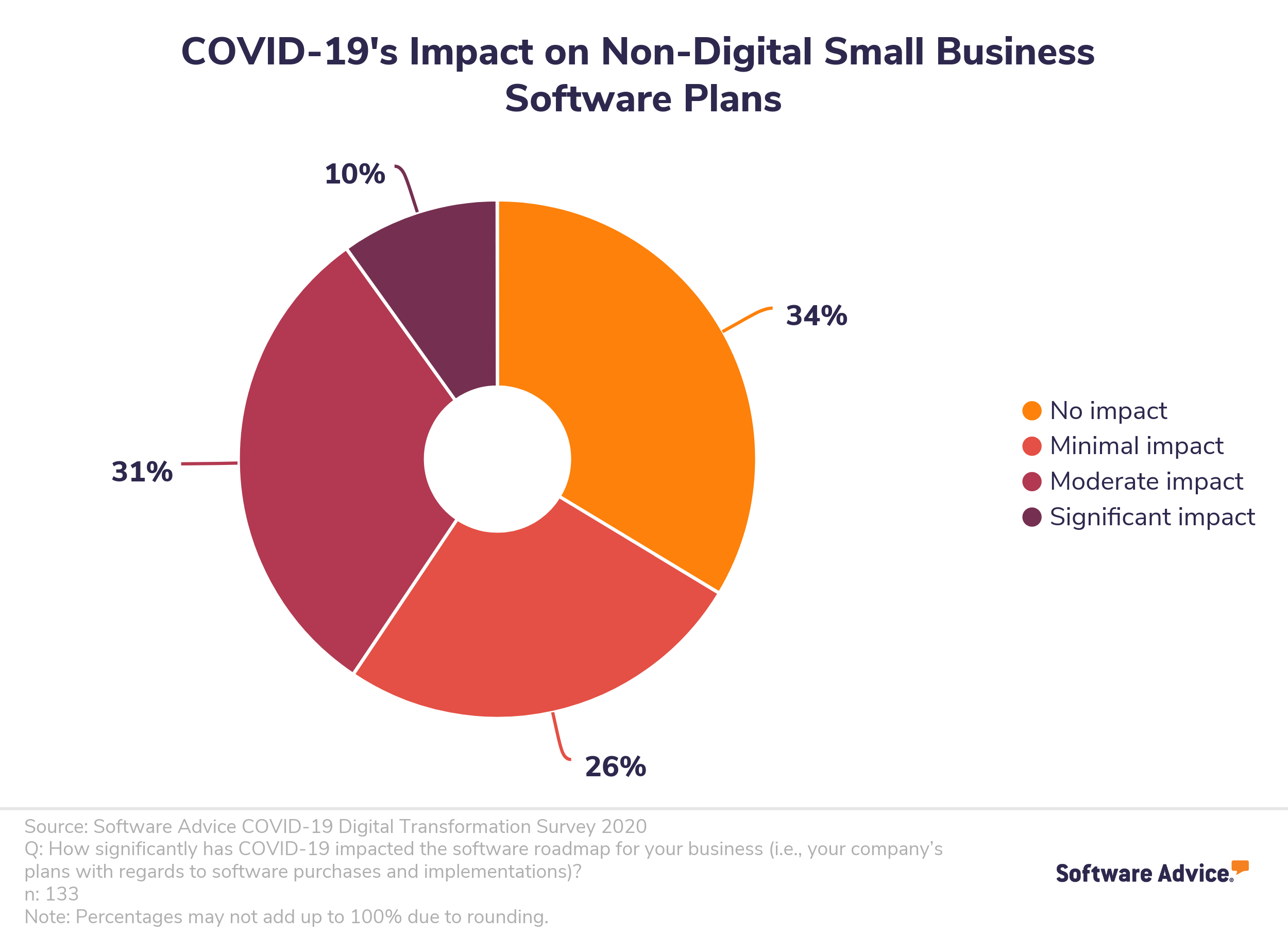

Key stat: 66% of non-digital small business leaders say COVID-19 has impacted their company’s plans regarding software purchase and implementation.

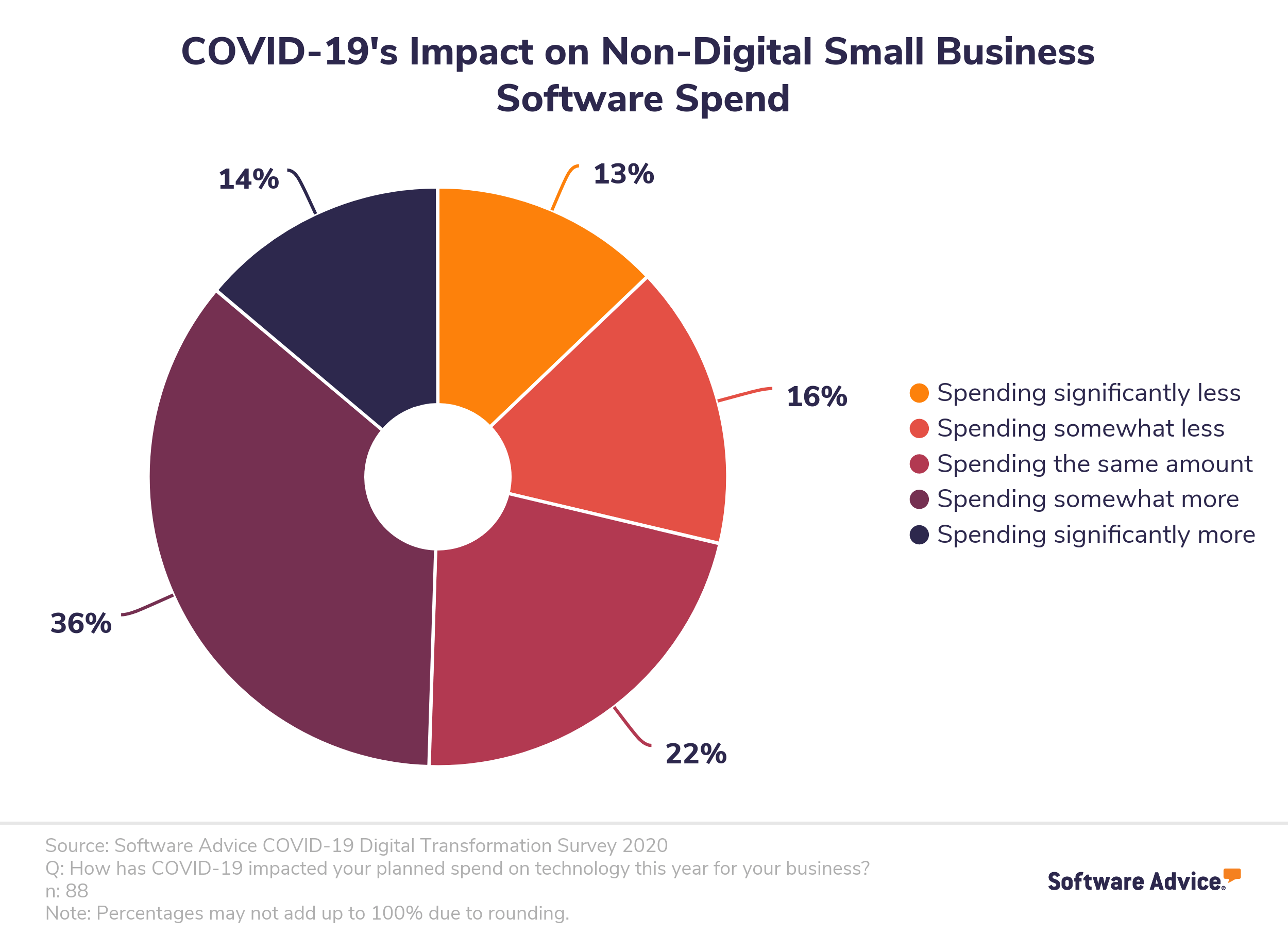

In order to implement the major changes needed to survive, non-digital small businesses are also making major changes to their software strategy. Nearly two-thirds (66%) of NDSB leaders say COVID-19 has impacted their plans for software purchasing and implementation this year.

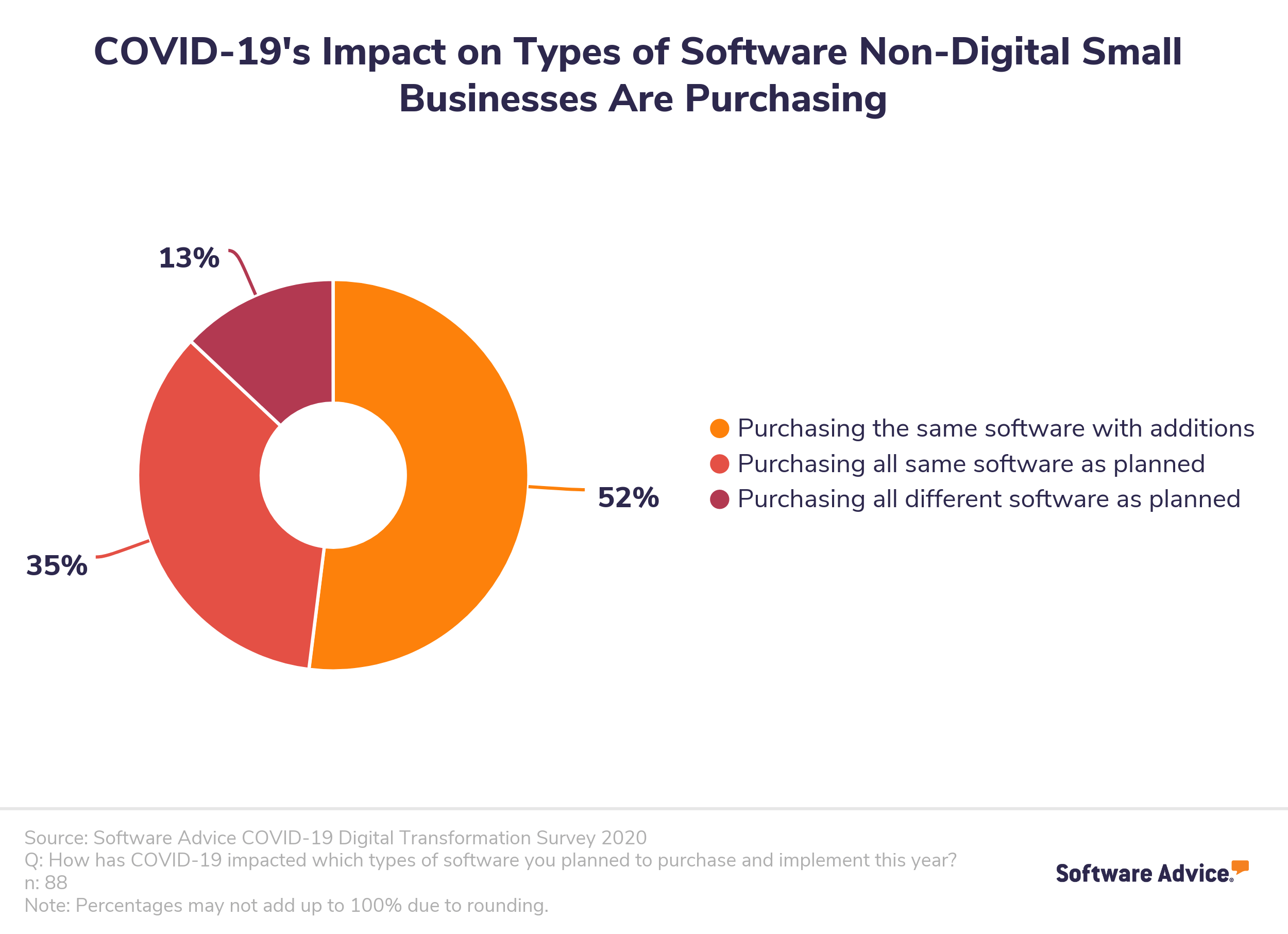

These plans are changing in several ways. For one, businesses are purchasing more types of software than originally anticipated. A majority (52%) of NDSBs whose software plans were impacted by COVID-19 say they’re purchasing additional systems on top of the ones they already had planned. As a result, 50% are spending more on software than anticipated.

As for the specific software systems these businesses are focusing their attention on, changes in Software Advice web traffic point to a variety of shifts in small business software research and purchase behavior in recent weeks.

Here are just some of the software categories on our site that have seen spikes in traffic due to COVID-19*:

Telemedicine software (+1,212%) – Relaxed regulations and infection concerns are pushing small medical practices to adopt telemedicine like never before. (Read “How to Get Started With Telemedicine”).

Virtual classroom software (+708%) – School doesn’t stop when school closes. K-12 and higher-education institutions are implementing virtual classroom and learning management system (LMS) software to continue teaching from home. (Read “5 Long-Term LMS Benefits for Schools and Universities”).

Online meeting software (+471%) – Whether it’s to enable remote worker collaboration or to have socially-distant interactions with clients, small businesses are investing heavily in online meeting software, no matter their industry. (Read “The Pros and Cons of Effective Remote Work”).

Food delivery software (+179%) – Restaurants around the country are putting systems in place to get their food to people stuck at home. (Read “3 Impactful Ways to Drive Your Restaurant’s Online Ordering Sales”).

*Percentages shown are for the period of March 9 – April 8 compared to February 3 – March 2.

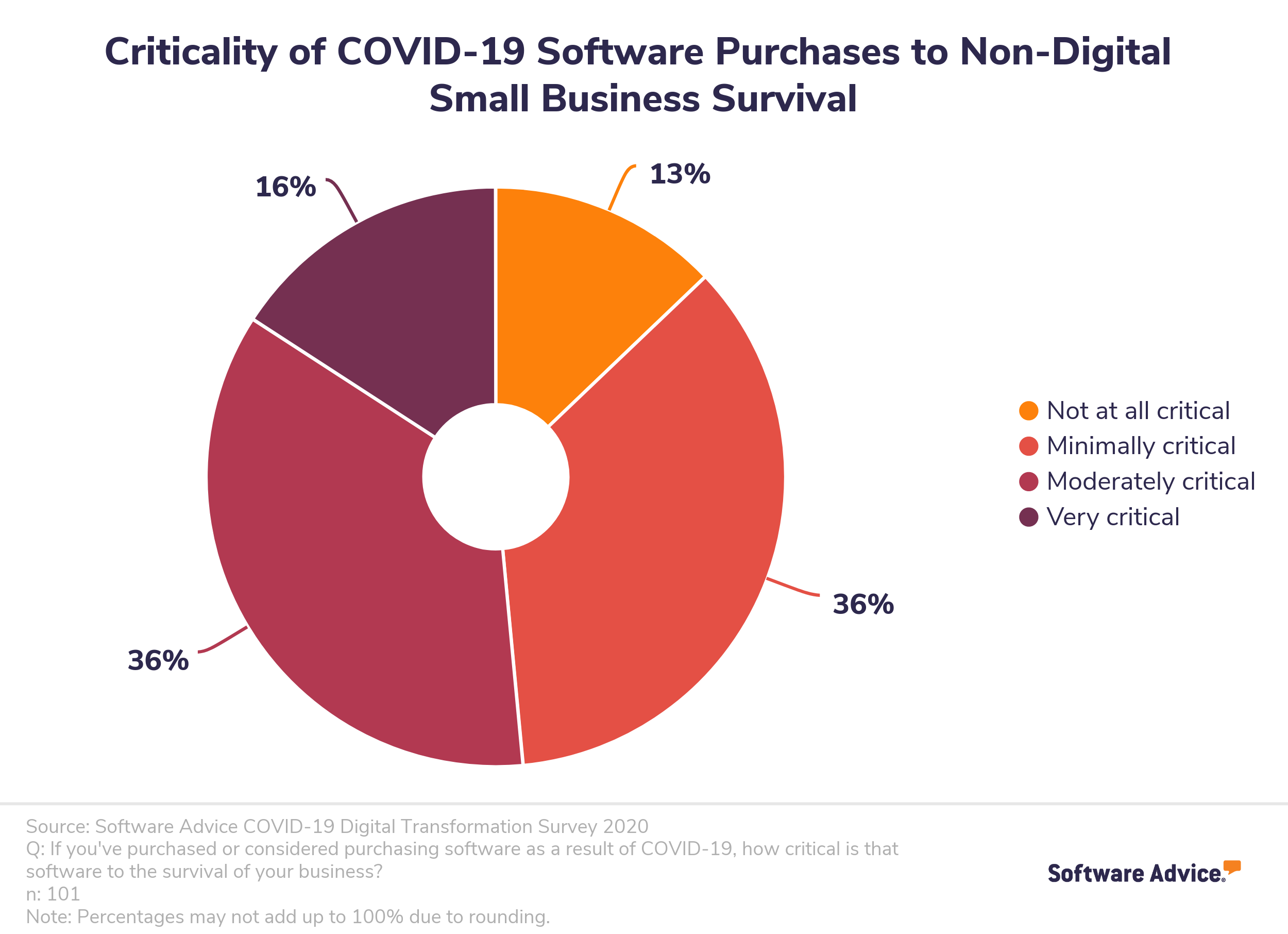

The only thing tying these software purchases together: necessity. Eighty-seven percent of NDSBs that are purchasing new software due to COVID-19 consider those purchases to be at least somewhat critical to the survival of their business.

Case story: Three60Fit

Christian Koshaba

owner of Three60Fit

I wouldn’t say it’s been a seamless transition, but I think it’s really opening people’s eyes. We can do this from all over the world if we wanted to.

Christian Koshaba

When Christian Koshaba opened Three60Fit outside of Chicago, IL in 2015, he envisioned it as a place where anyone could come to develop their mind, body, and spirit. By 2020, he employed six trainers helping 80-90 members with their wellness goals.

In mid-March, disaster struck: Three60Fit had to close its doors to non-essential activities. The business hit a 50% revenue slump almost immediately.

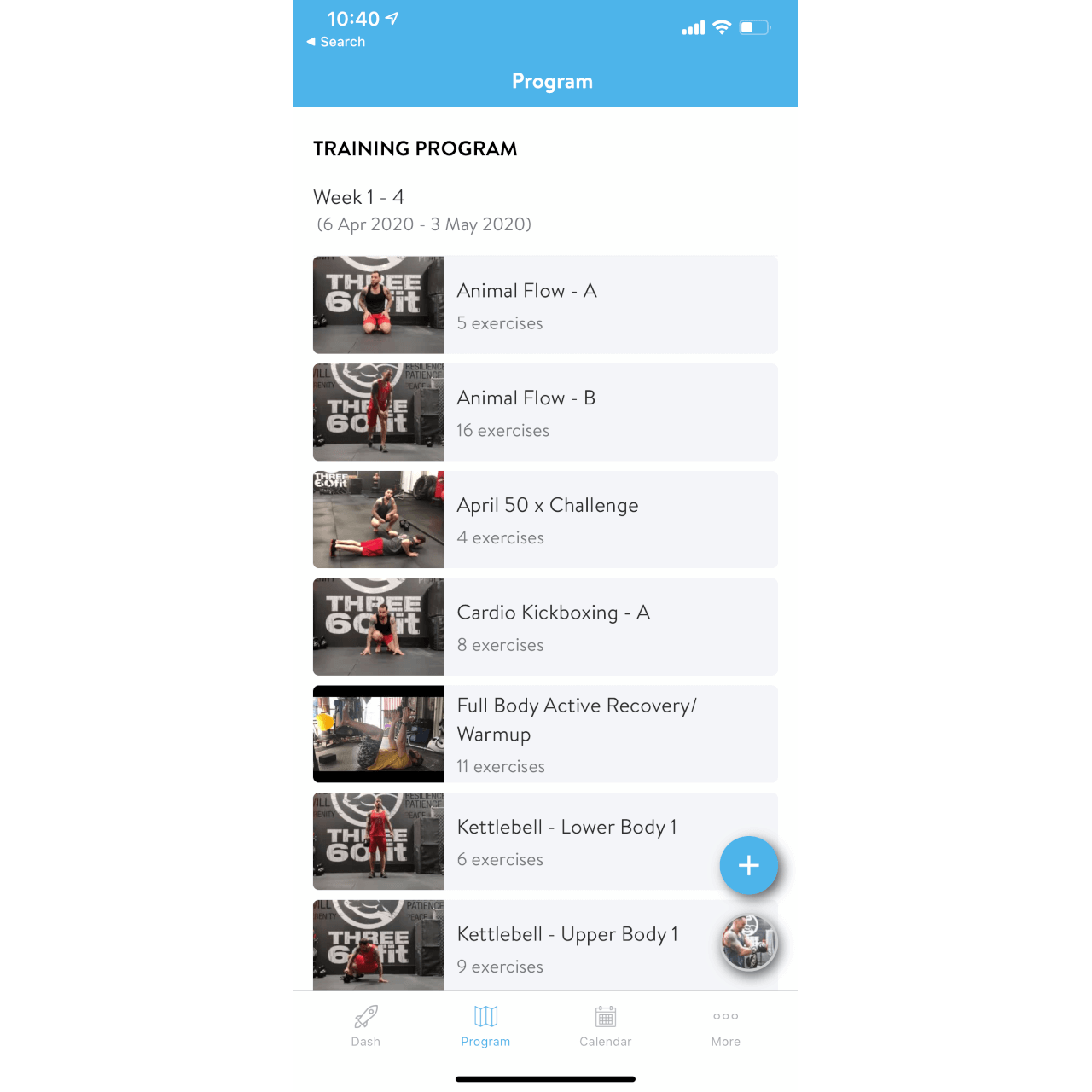

Working quickly, Koshaba spent two weeks filming over 100 videos of himself doing all of the exercises he would normally demonstrate in class. Using Trainerize, a software platform for personal trainers, Koshaba uploaded the videos he made to create a structured workout program that Three60Fit members could follow from home.

Three60Fit members are keeping up with their workouts using the Trainerize platform.

Besides doing the workout program, Three60Fit members are using Trainerize as a group message board to chat, share workout tips, and stay in touch. The system also allows members to rate and comment on each workout, which is helping Koshaba improve the regimen.

In addition, Koshaba has implemented video conferencing tool Zoom in tandem with membership management system Zen Planner to schedule and host four live virtual classes each week that anyone can sign up for. To help those lacking proper equipment at home, he’s lending or renting out equipment from his closed gym.

So far, the results are promising. Though Three60Fit is still operating at a loss, revenue is trending back up. More impressively, the now completely virtual gym has only lost 10% of its members. Koshaba hopes promoting the Trainerize program on his website and social media—alongside implementing a meal-planning tool called Evolution Nutrition—will improve things further.

But even when things return to normal, Koshaba doesn’t see his virtual gym going away.

“What I see coming out of this is more of a hybrid application to fitness,” Koshaba says. “There’s still going to be the brick-and-mortar classes, but there’s also going to more of the virtual platform in conjunction with actually going to the gym.”

The Bottom Line: Non-digital small businesses are significantly altering their digital transformation journey due to COVID-19. Though a variety of systems are being implemented quickly out of necessity, many see these investments as a new permanent fixture of their business that will continue to provide value after the crisis is over.

5 tips for going digital, quickly

The COVID-19 crisis has been an unprecedented hit to non-digital small businesses. In addition to cutting costs and seeking aid, many are making significant changes—some they never imagined for their business—just to hang on.

As a result, they’re also changing their digital transformation journey. Not only are these businesses adopting new software to digitize manual processes, they’re doing so quickly, truncating a process that can take months or years to just a few days.

If you’re a non-digital small business being forced to go digital due to COVID-19, we’re here to help. Use these five tips to help make this transition as quick and seamless as possible:

Talk to our software advisors. Our advisors can shorten the time you spend finding software options from days down to 15 minutes. Tell us your needs, and we’ll send you a shortlist of best-fit systems. It’s that simple. Click here to chat with one of our advisors right now, free of charge. You can also schedule a phone call for a later time, if that’s more convenient.

Ask vendors if they’re offering special rates. In response to the crisis, many software vendors are selling their products at a deep discount. Some are even offering them for free; keep your eye on Forbes’ running list of software deals. Talk to any vendors you’re interested in to see if they’re offering any ways for you to save money on your purchase.

Isolate and focus on your immediate needs. Even rushed software implementations aren’t immune to scope creep. Work with your vendor to identify the functions you need to get up and running to keep your business going right now.

Set proper expectations with customers and employees. Most, but not all, will be understanding of your sudden shifts right now. Where possible, ask customers and employees to be patient as you sort through the hiccups of your digital transformation.

Add on, test, and repeat. Once your immediate needs are taken care of, add “nice-to-have” software features one at a time. Test them for a day or two, then if things are going well, move on to the next one on your list. If you hit a snag, you’ll be able to hone in on the problem immediately.

Survey Methodology

The Software Advice COVID-19 Digital Transformation Survey was conducted in April 2020. We surveyed 503 small business “leaders,” defined as full-time employees at the vice president, president, C-suite, or owner/founder level at U.S.-based businesses with 2-250 employees. The non-digital small business results reported here are from 133 respondents who said most or all of their business has to be done in-person.

We worded the questions to ensure that each respondent fully understood the meaning and the topic at hand.