Decision Fatigue is Ruining Online Shopping, But Existing Tech Can Help

Today’s online shopper faces a vexing paradox: Despite having exposure to more products than ever before, it’s gotten harder to find what you really want.

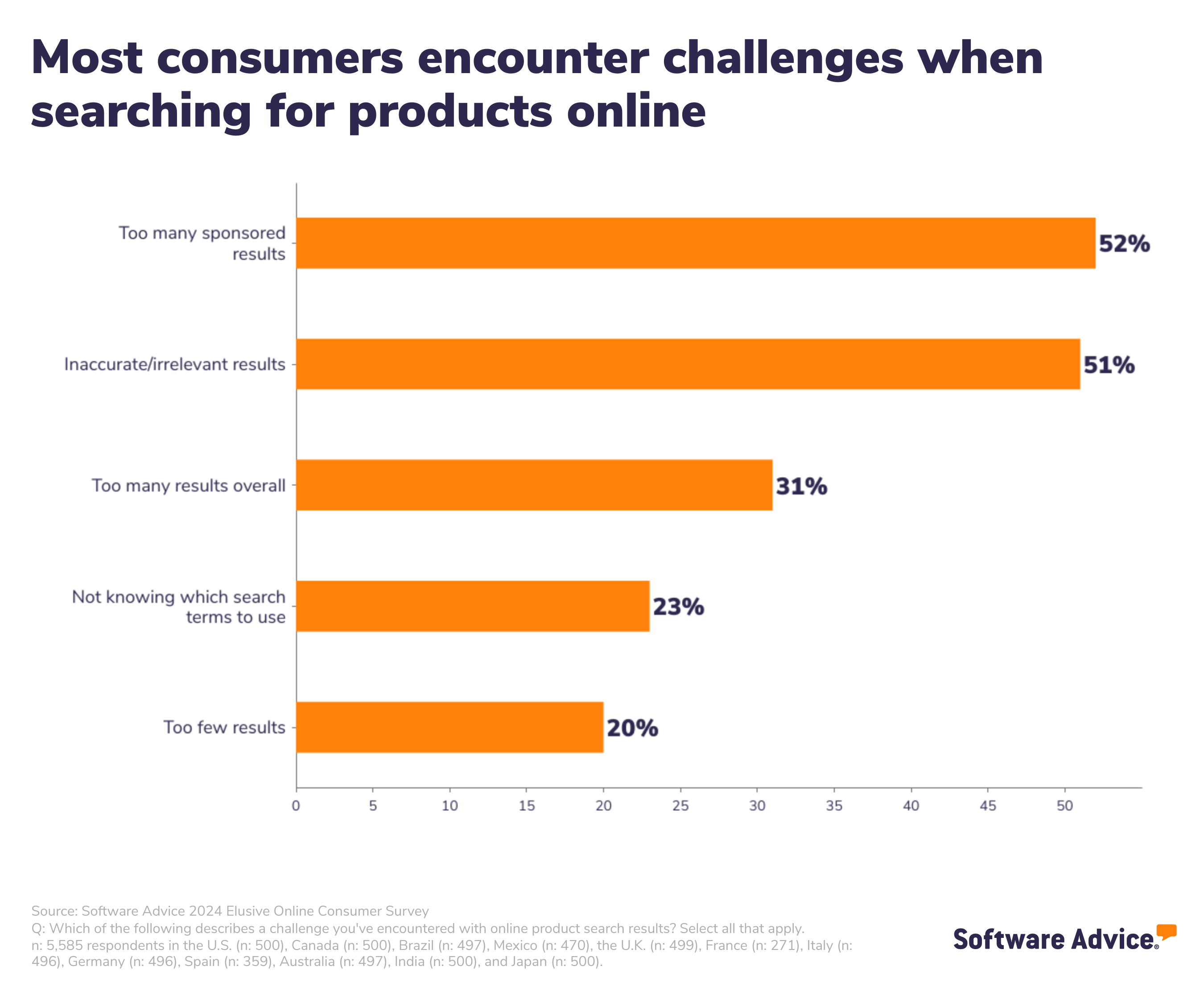

Software Advice’s 2024 Elusive Online Consumer Survey* of over 5,500 consumers across 12 countries reveals that when searching for products online, most global consumers are met with far too many unhelpful search results, including sponsored, inaccurate, or irrelevant product listings. On top of that, search filters are often ineffective, and consumers are left to do their own analysis on a sea of product reviews.

The result is decision fatigue, which can lead to cart abandonment and avoidance of ecommerce websites with poor site search functionality. The last thing small to midsize retailers want is a negative user experience that sends customers running to their big-box competitors.

To avoid the consequences of a poor search experience, retailers should update their keyword strategy, site search functionality, and reviews analytics so their products are easier to discover and their websites are easier to browse.

Key insights

52% of global consumers start their online search for products on retailer websites—67% start on search engines and 46% on ecommerce marketplaces.

Only 34% of online shoppers who begin their search for products on social media make their final purchases on social media.

23% of global consumers find it challenging to know which search terms, or keywords, to use to find products they want online.

While most (77%) of global consumers regularly use search filters when shopping online, 84% of those consumers encounter challenges when using them.

After price, user reviews are the second most important factor in a consumer’s purchase decision.

Today’s online product search creates decision fatigue and needs an overhaul

The way consumers have to search for products in today’s vast global ecommerce network is time-consuming and chaotic. An abundance of choice, unhelpful filters, and untrustworthy reviews have created a contradictory system that in theory offers a world of choice, but in reality offers a fairly limited selection for today’s busy consumer. After all, who has the time or attention span to comb through all the possibilities out there? What we’re left with is a virtuous cycle for the few products that have paid to occupy the coveted real estate at the top of online search results, and a frustratingly cluttered mess to sort through for shoppers who are willing to explore further.

Most consumers start their product search on search engines, individual retailer websites, or ecommerce marketplaces. Once there, they encounter an overwhelming abundance of choice, mediated by algorithms that privilege sponsored products and brands and often suggest items that are not accurate or relevant to their query.

Search filters are supposed to help shoppers narrow their options, and over three-quarters (77%) of consumers regularly use them when browsing online. But it’s an imperfect system riddled with frustrating issues—users that regularly use them report that filters are often incorrectly applied to products (45%), lack a helpful degree of specificity (44%), or are too sparse to meaningfully narrow product selections (34%).

Then, once consumers have managed to narrow down their options, they still have to spend time scrutinizing product reviews to determine whether the reviews are trustworthy, after which point they can start determining a product’s quality. Shoppers take product reviews seriously—in 2023, Capterra found that 83% of U.S. consumers look for product reviews always or often before making a purchase.** And the importance of genuine reviews on purchase decisions is only increasing as product quality nosedives and fake reviews increase. [1, 2]

All of this detective work negatively impacts customer experience, while making it harder for smaller brands to be discovered. To stay competitive with the large retailers that take up the lion’s share of search results real estate, small and midsize retailers need to cater to how online product search has changed in recent years, and improve the experience customers have when browsing their website. Keyword strategy, search filters, and product reviews are three great places to start.

Social media has changed how people search for products

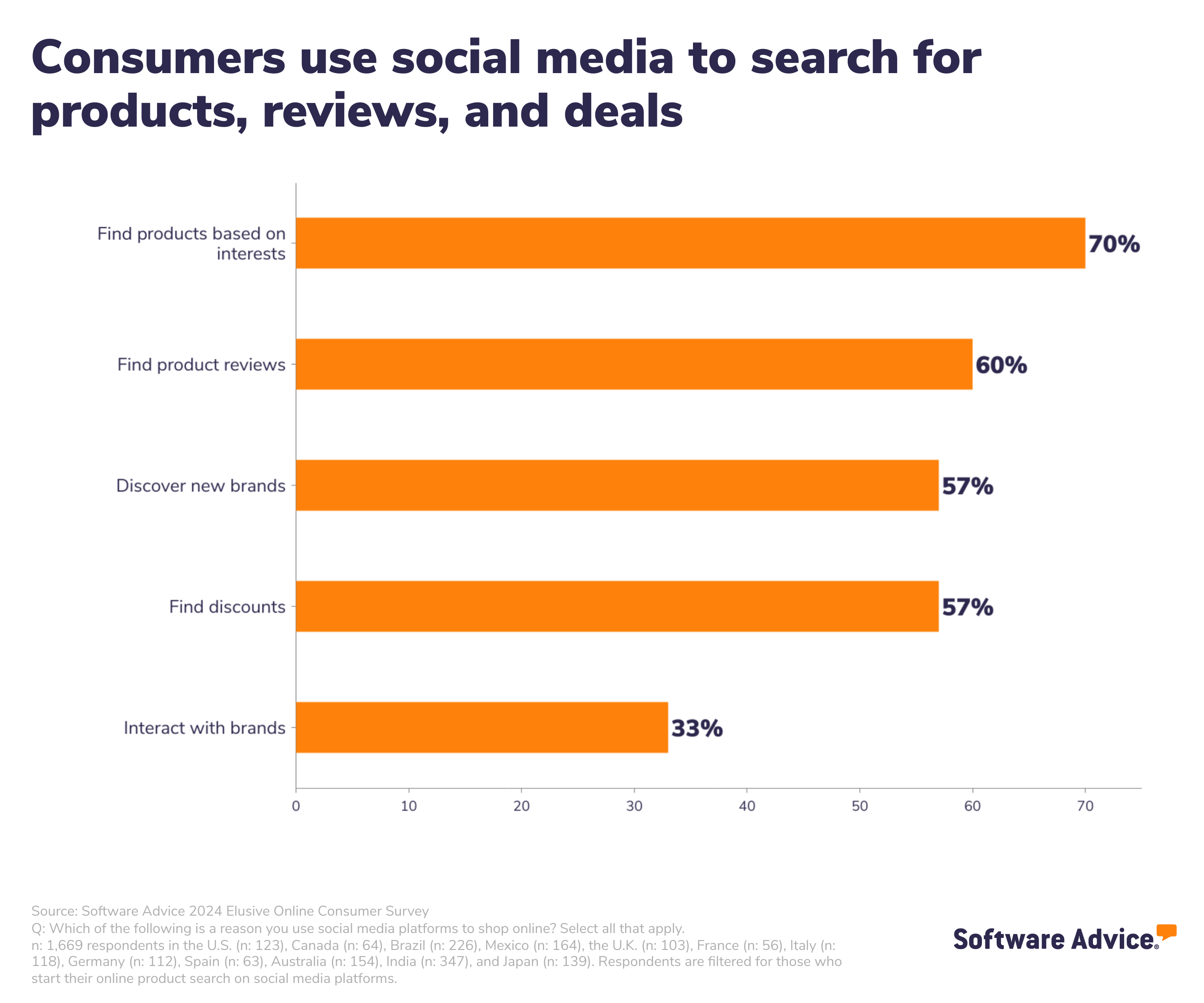

Social media is a gold mine for online shoppers, and 30% of consumers around the world begin their online product search on platforms such as Instagram, YouTube, and TikTok. Consumers like using social media platforms as an ecommerce search engine because their content provides social proof for products and brands, they’re the point of origin for today’s trends, and their personalized algorithms constantly serve up content related to products they’re likely to want.

Though many social platforms now offer in-app points of sale, most shoppers still navigate away to retailer websites (62%), ecommerce marketplaces such as Amazon (56%), or department store websites (47%) to make their final purchases. Sometimes, social media content will contain affiliate links, brand mentions, or descriptive captions to facilitate this transition. But when the content creator hasn’t left such clues, it can be tricky for viewers to track down the items they’re looking at.

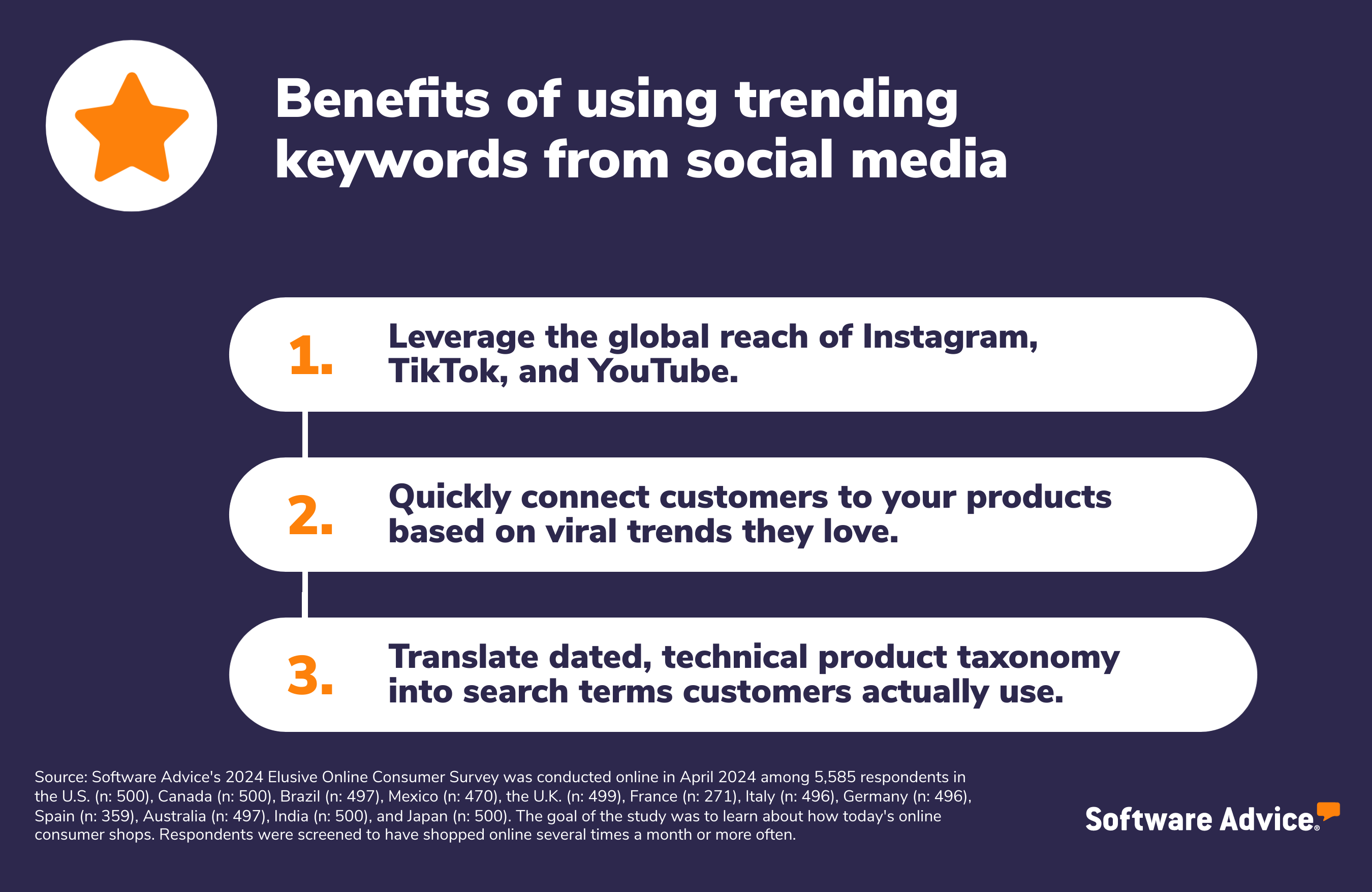

Not enough retailers incorporate language from social media trends into site search functionality, so shoppers are sometimes at a loss when popular keywords from Instagram don’t match up with retailer taxonomy. For example, try searching the phrase “quiet luxury” into Banana Republic’s website search bar and you’ll get zero results, though the brand is highly touted by TikTok influencers who post viral content related to the “quiet luxury” trend. [3]

To this end, well over a quarter (29%) of shoppers who use social media for product research find it challenging to know which search terms to use when shopping online. An enormous opportunity lies in bridging the keyword gap between social media and retailer websites.

TOOL TIP

As online shoppers continue to use social media to inspire their purchases, retailers should make it as easy as possible for users to find products using trending keywords from TikTok, Instagram, and other social platforms, by incorporating those keywords into product names and descriptions. AI-powered social monitoring software scrapes social media platforms for market trends, analyzes keyword performance, and tracks engagement so businesses can hone their strategy.

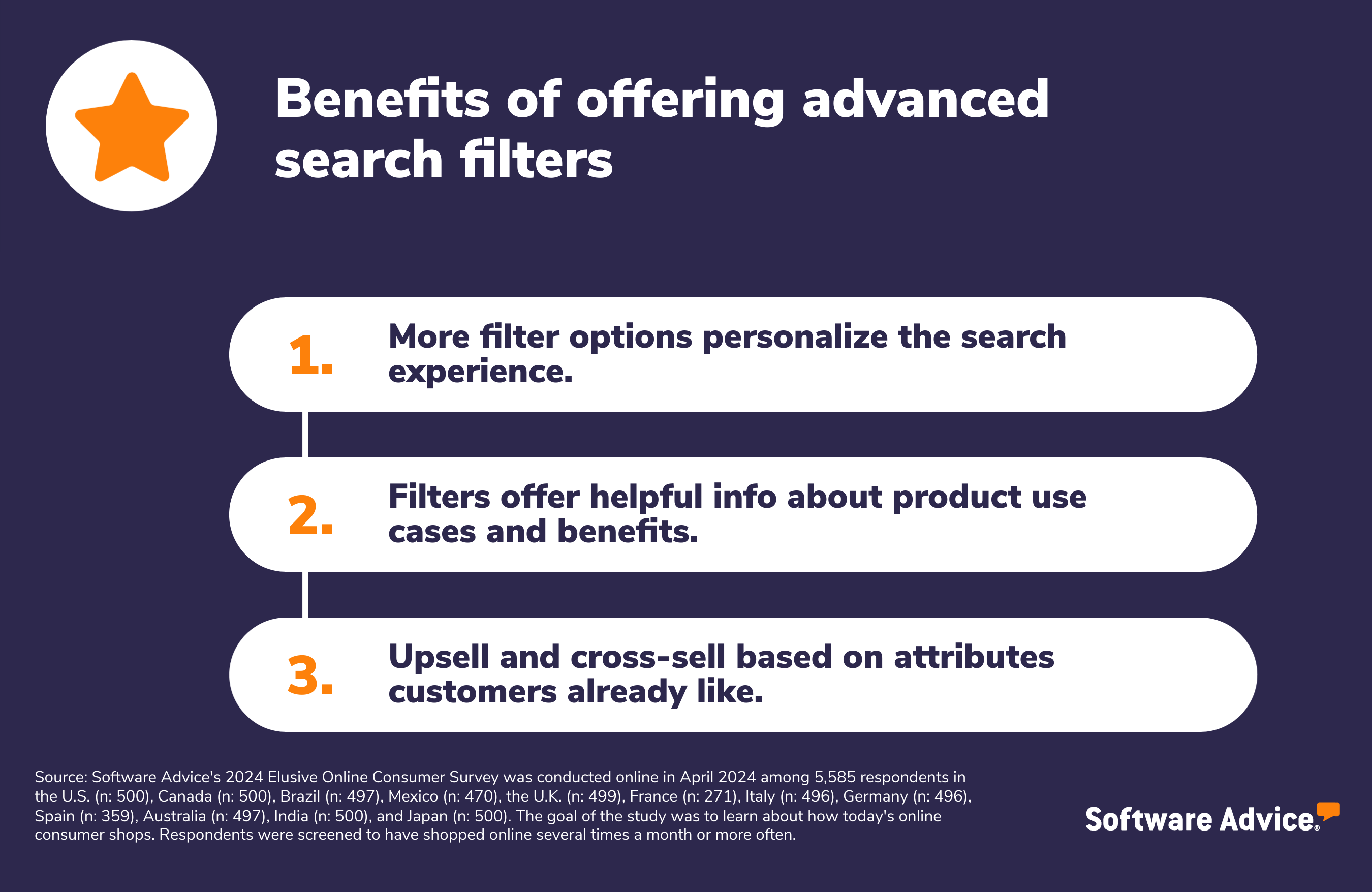

Consumers want fine-tuned faceted search

To better match customers to the products they want, retailers should go beyond the basics with search filters and allow customers to narrow their searches by more attributes than just product category, price, size, or color. This strategy, known as faceted search, allows customers that don’t have a clear idea of what they want to buy to search for products using preferred category-specific attributes, such as “occasion” for dresses, dimensions for furniture, or ingredients for cosmetics. This can help customers cut down on time spent scrutinizing individual product detail pages, and avoids the possibility that a keyword query will return zero results.

In this way, faceted search is an effective upselling or cross-selling tool. By letting customers filter for attributes they already know they like, retailers have the opportunity to surprise shoppers with personalized results.

TOOL TIP

Most ecommerce software includes features for categorizing products and building ecommerce storefronts with search widgets. Some enterprise search software is specifically designed for ecommerce and offers customizable and automated filtered search capabilities, such as natural language processing and query suggestions.

Reviews should be summarized in seconds

After price, user reviews are the second most important factor in a consumer’s purchase decision. Consumers are discerning about which reviews they trust, and many are wary of reviews from unverified, unfamiliar, or potentially biased sources. For instance, they deem review sites and word of mouth from friends or family as the most trusted sources for product reviews, over internet search engines, online forums, and social media. They’re over twice as likely to trust a review made by an everyday social media user versus an influencer.

There are a variety of review attributes consumers consider critically important. Consumers want the full picture of not just how the product performs in general, but how it might suit their specific lifestyle or physical characteristics. Granular details such as reviewers’ measurements, specific use cases, and user-generated images offer helpful context that shoppers appreciate.

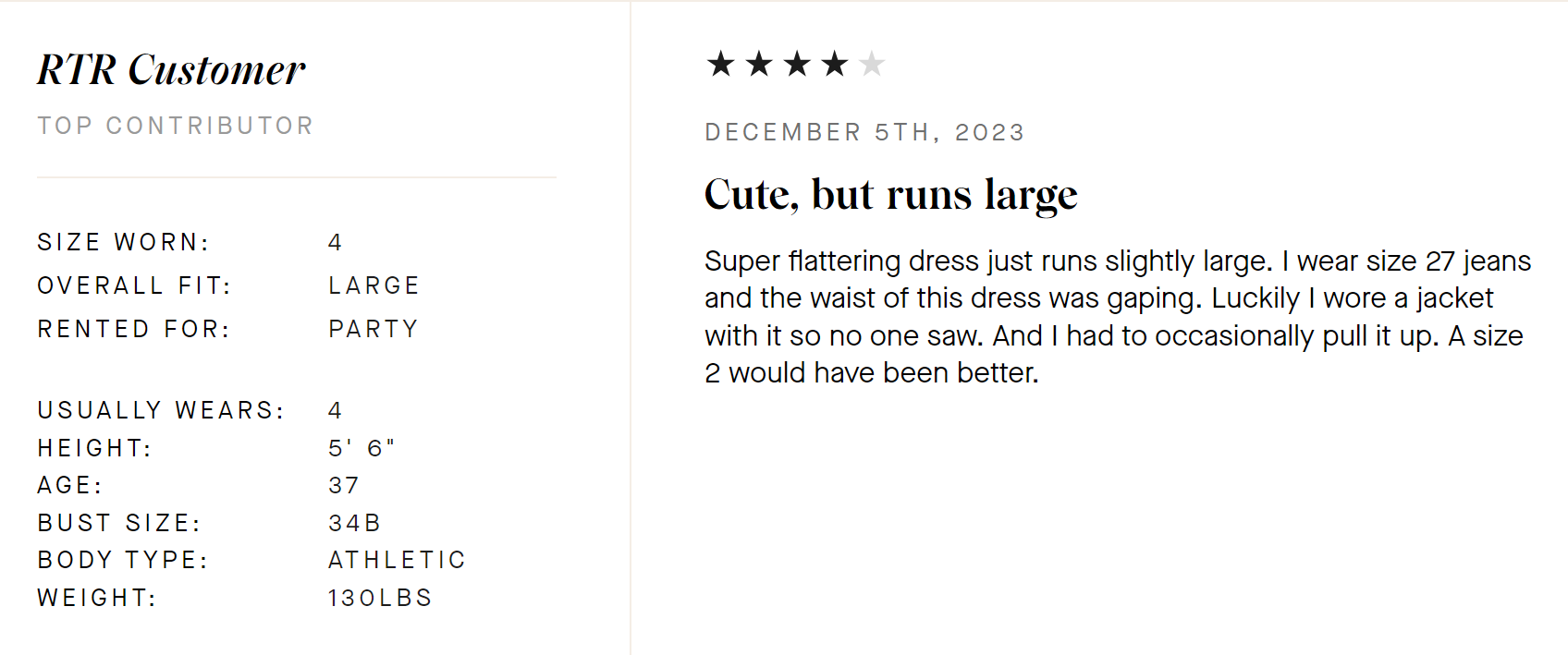

This retailer invites reviewers to share specific measurements and detailed comments to give customers a deeper understanding of fit and performance. It also tags prolific reviewers as “top contributors” to indicate trustworthiness and expertise. Source: [4]

Since combing through reviews one by one is time-consuming, retailers should offer review filters and data visualization to better communicate the information captured by reviews and allow users to narrow reviews to only those relevant to them.

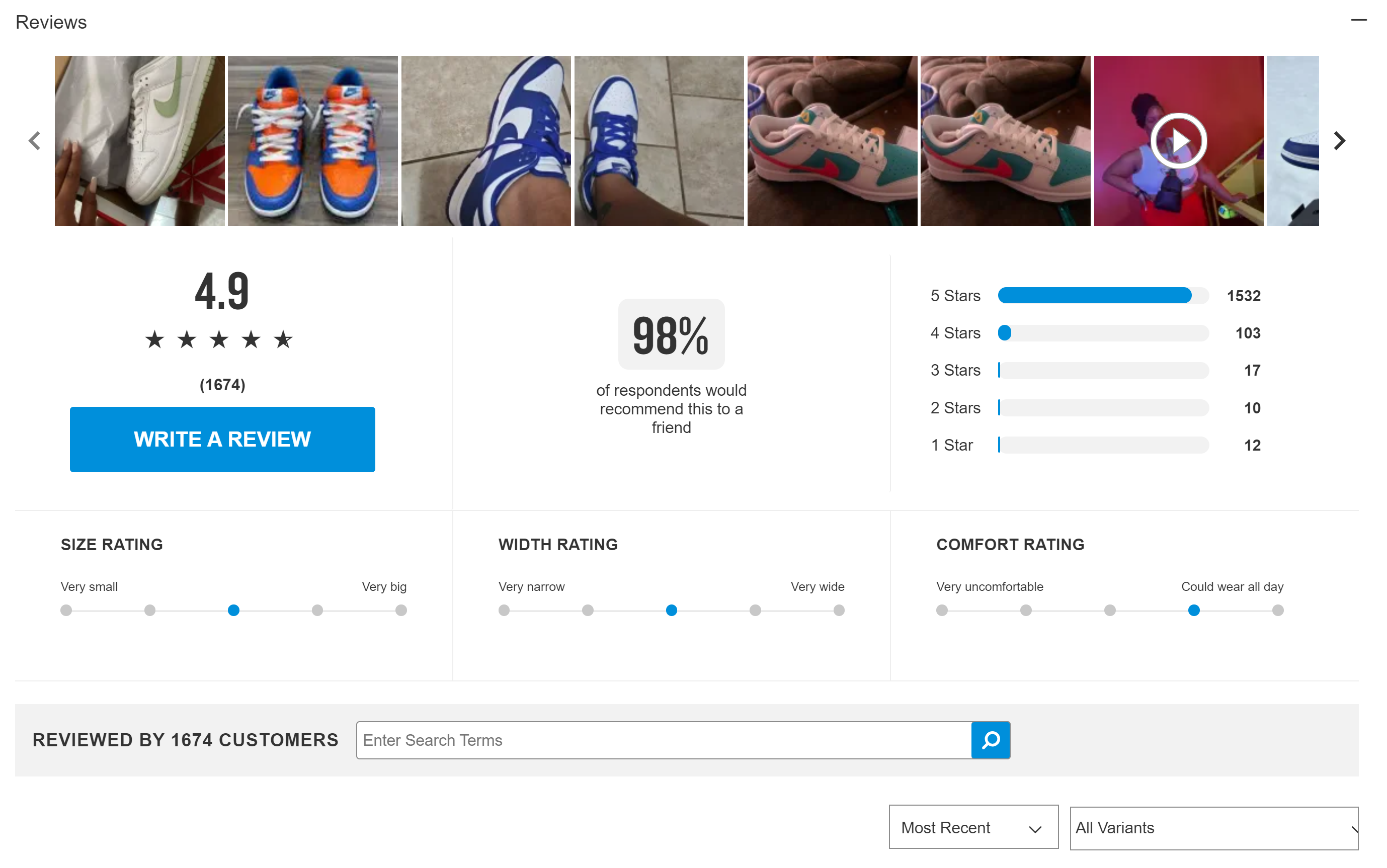

This retailer offers at-a-glance analytics and image thumbnails in the review section of product detail pages, saving customers time. Source: [5]

For instance, leading retailers in clothing and footwear often provide quick stats in the reviews section of product detail pages, such as a percentage breakdown of star ratings, a true-to-size rating, and options to sort by rating, recency, size purchased, or reviews containing images.

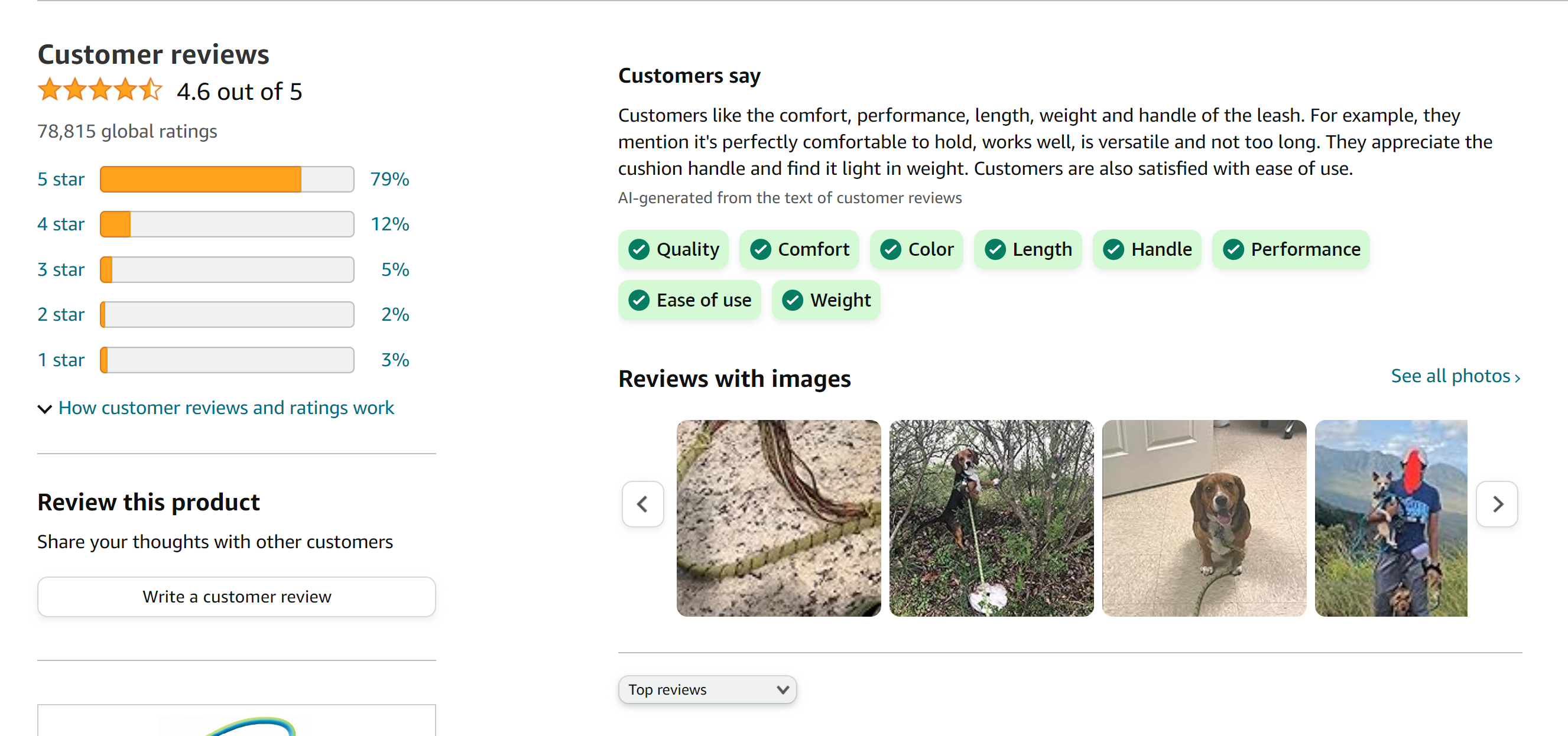

On the cutting edge, some retailers use generative AI to produce snapshot summaries of reviews, giving customers an instant consensus from reviewers, with more detail than a star rating.

Generative AI can be used to quickly summarize thousands of text-based reviews. Source: [6]

Making reviews easier to digest also helps cut down on return logistics costs. By getting more information before they buy, customers can more easily find the right products for them, reducing the likelihood that they’ll return the product because they dislike its size, color, or material.

TOOL TIP

Review management software is designed to help businesses request and manage feedback from customers. Most tools have automated features that monitor the sentiment, rating, and keywords of reviews so businesses can quickly address concerns.

Leverage software to improve customer experience when browsing your website

Don’t leave customers out to dry with decision fatigue caused by poor online search experiences. An updated keyword strategy can help customers cut through the noise to find your products on search engines and ecommerce marketplaces, while improving your site search experience with helpful filters and review analytics delivers a satisfying customer experience once shoppers reach your site.

TOOL TIP

One way to determine where your search strategy needs the most improvement, and to measure the effectiveness of any changes you make, is by tracking your business’s performance using customer relationship management (CRM) software. Improvements to metrics, such as net new revenue or net promoter score (NPS), are a good sign that it’s easier for customers to discover and use your website. Reducing your customer acquisition cost (CAC) after incorporating keywords from social media indicates you’re doing a better job of segmenting your audience.

Finding the right software is critical to improving customer experience on your website. If you’re not sure where to start, try chatting one-on-one with an advisor from Software Advice for free to get personalized help and recommendations.

Sources

Online reviews are increasingly fake, say researchers. Here's why, and how to spot them, CBC

Shay in June [@shayinjune], TikTok

Image caption, Rent the Runway

Image caption, Finish Line

Image caption, Amazon

Survey methodology

*Software Advice’s 2024 Elusive Online Consumer Survey was conducted online in April 2024 among 5,585 respondents in the U.S. (n: 500), Canada (n: 500), Brazil (n: 497), Mexico (n: 470), the U.K. (n: 499), France (n: 271), Italy (n: 496), Germany (n: 496), Spain (n: 359), Australia (n: 497), India (n: 500), and Japan (n: 500). The goal of the study was to learn about how today's online consumer shops. Respondents were screened to have shopped online several times a month or more often.

**Software Advice’s 2023 Retail AI Security Risks Survey was conducted in July of 2023 among 1,000 U.S. consumers to learn more about their attitudes and behaviors regarding artificial intelligence tools in online shopping. Respondents were screened for online shopping frequency; all respondents shop online at least once per month.